Business Insurance in and around Houston

Houston! Look no further for small business insurance.

Helping insure small businesses since 1935

Insure The Business You've Built.

Whether you own a a tailoring service, a cosmetic store, or an antique store, State Farm has small business coverage that can help. That way, amid all the different options and moving pieces, you can focus on navigating the ups and downs of being a business owner.

Houston! Look no further for small business insurance.

Helping insure small businesses since 1935

Cover Your Business Assets

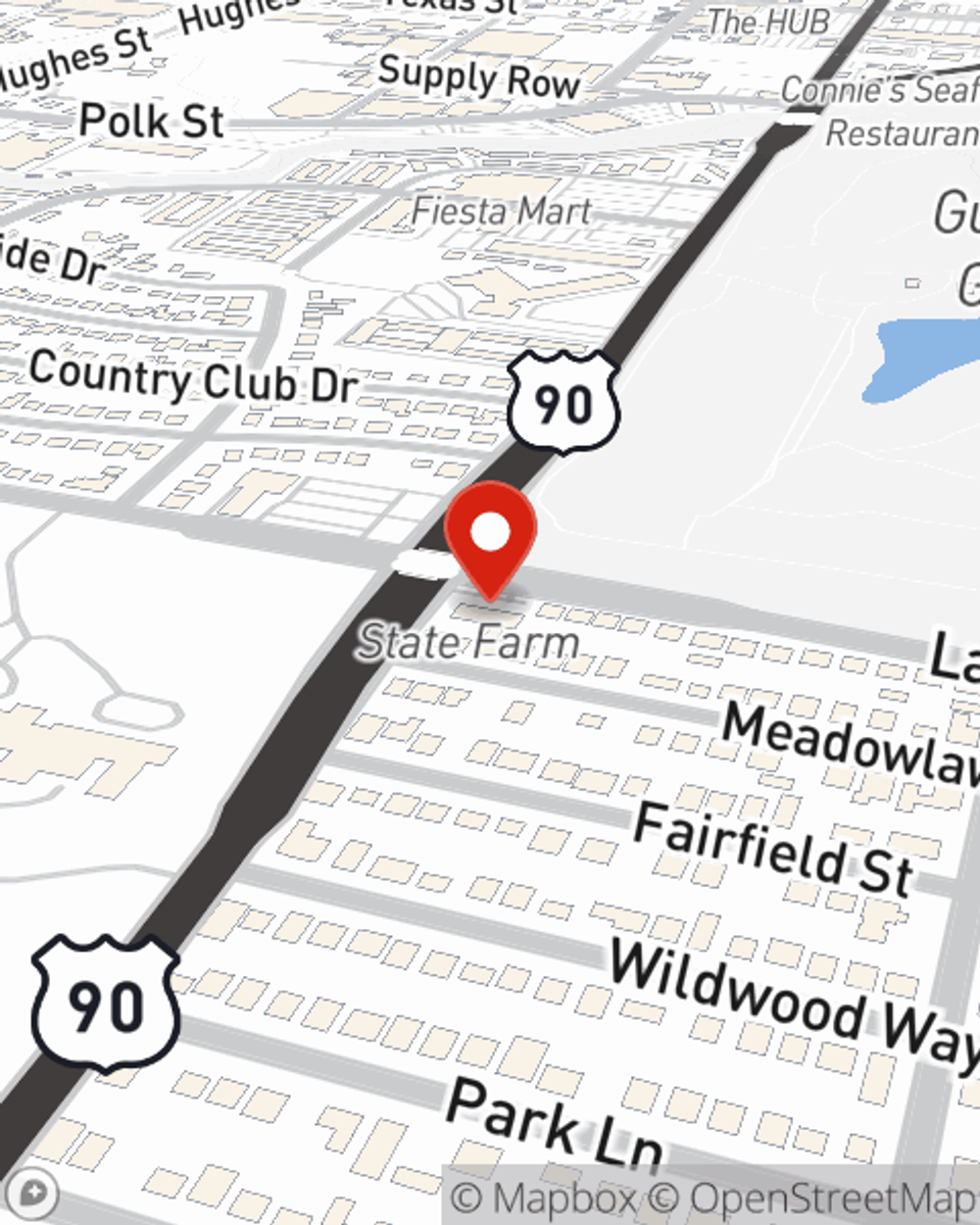

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Andrew Perez. With an agent like Andrew Perez, your coverage can include great options, such as commercial auto, artisan and service contractors and commercial liability umbrella policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Andrew Perez is here to help you learn about your options. Get in touch today!

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Andrew Perez

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.